Don't miss this chic and contemporary 1-bed, 1-bath in an unbeatable location. High-rise living at its finest, this home offers incredible amenities including 24/7 doorman, pool, gym, dry cleaners, indoor parking and more in the sought after Lincoln Park neighborhood with easy access to Lake Michigan and Lake Shore Drive. The entertainment space is bright and modern with gray wooden floors highlighted by designer light fixtures and floor-to-ceiling windows. The full-size kitchen boasts stainless-steel appliances, luxe quartz countertops and plenty of custom cabinetry. The entertainment space continues on your private balcony with breathtaking unobstructed views of the city. You don't want to miss this one - call today for more info!

Chicago Real Estate Market Update - March 2021

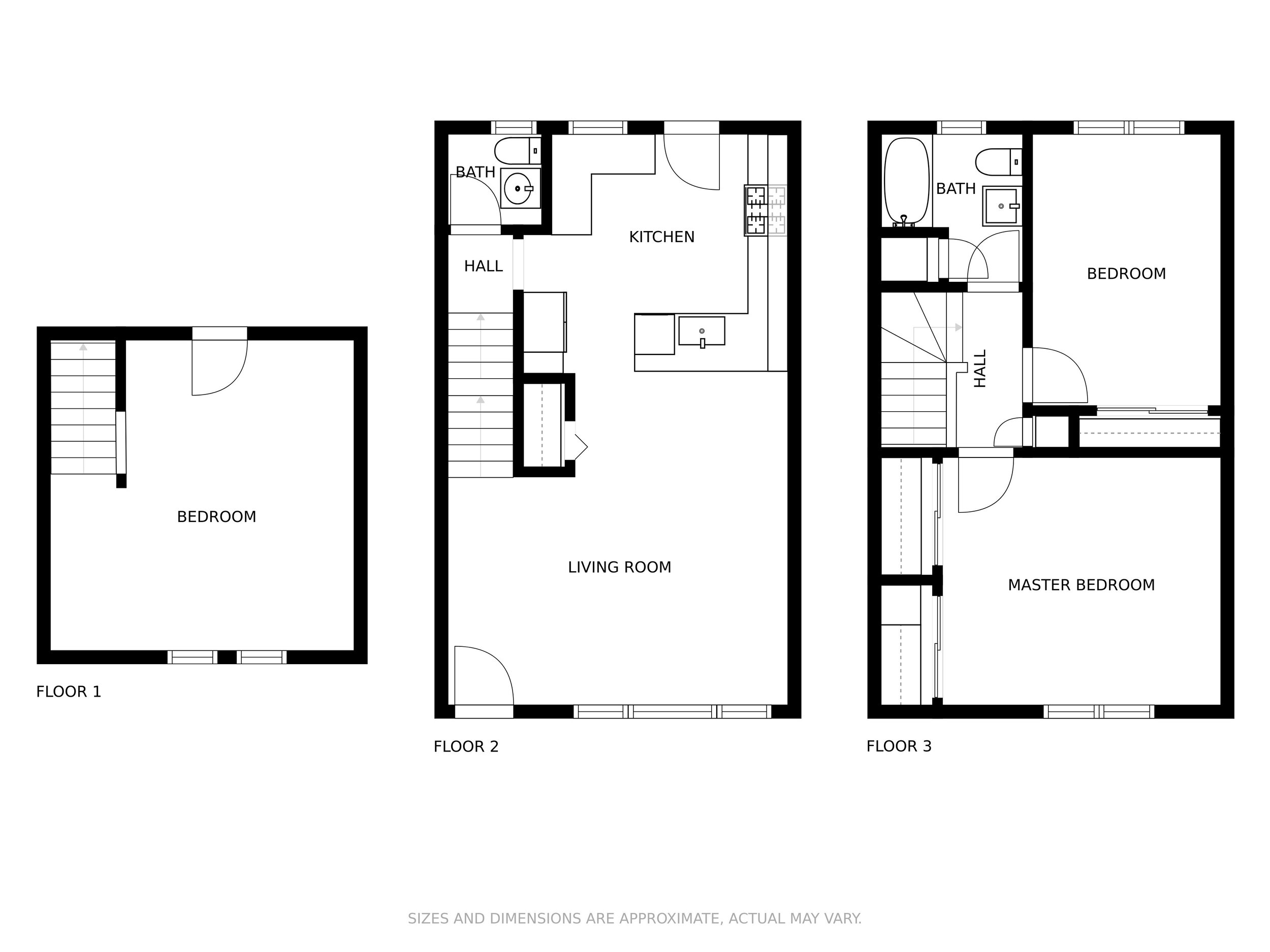

Oak Park Property for Sale | 644 Washington Blvd Unit A | 2 Bed | 1.1 Bath | $300,000

Listing Description

Don't miss this stunning updated townhouse in the village of Oak Park just a quick commute to the city. Renovated in 2017, this like-new home is full of character and completely move-in ready. Modern yet timeless, the high-end fixtures and designer flooring pair effortlessly to create the perfect space. An open entertainment area, oversized gourmet kitchen and bonus breakfast bar seating make this home as practical as it is cool. You'll love the private patio with space to entertain or relax with a cup of coffee. Beautifully designed and centrally located, this one won't last long. Schedule your private showing today!

Interested? Get More Info Below.

Location:

644 Washington Boulevard

Oak Park, IL 60302

South Loop Property for Sale | 1111 S Wabash Unit 911 | $375,000

Don't miss this bright and spacious 2-bedroom in the South Loop. Sitting in a high rise building with 24/7 staff, you will love the endless amenities including a gym, on-site cleaners, outdoor pool and more. The unbeatable location is right near Michigan Ave., Grant Park and all the best local shops and dining. Beautifully finished and full of natural light, this spacious apartment offers a sleek kitchen with luxe granite countertops and stainless-steel appliances, an open concept living and dining room combination and a sprawling balcony with stunning city skyline views. This is a must-see home - call today for more info!

Albany Park Property for Sale | 4944 N Drake Ave | Renovated 2 Flat | $675,000

About the Property

A stunning investment or income property opportunity, this two-flat duplex sits on a quiet, tree-lined street in Albany Park and is right where you want to be. The main level offers two bedrooms, one bath plus an additional 3 bedrooms and bath in the lower level, and the upstairs unit has three bedrooms and one bath, all tastefully updated and beautifully finished. Soaring ceilings in each highlight oak hardwood flooring and open concept floorplans fitted with recessed lighting. Everything has been recently updated, including the bathrooms and kitchens that boast beautiful stainless-steel appliances and quartz countertops. Renovated backyard/patio with custom built in grill, perfect for entertaining. A spectacular opportunity you don't want to miss!

Schedule your private showing today!

Interested? Get More Info Below.

Location:

4944 N Drake Ave

Chicago, IL 60625

2021 Chicago Real Estate Market Predictions

In this video I join a panelist of Chicago Real Estate Brokers and we give our predictions for the 2021 Chicago real estate market and discuss the current market conditions.

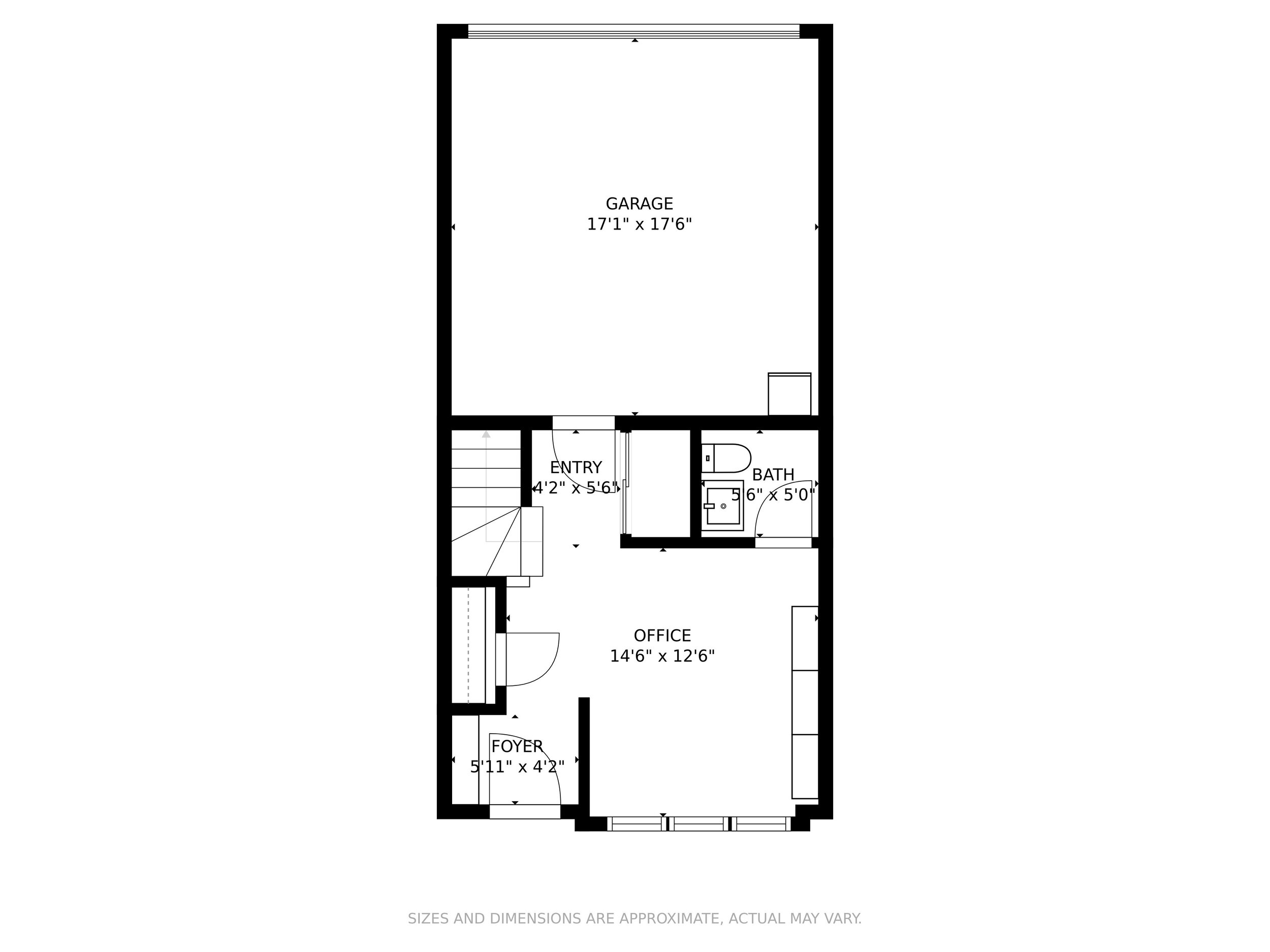

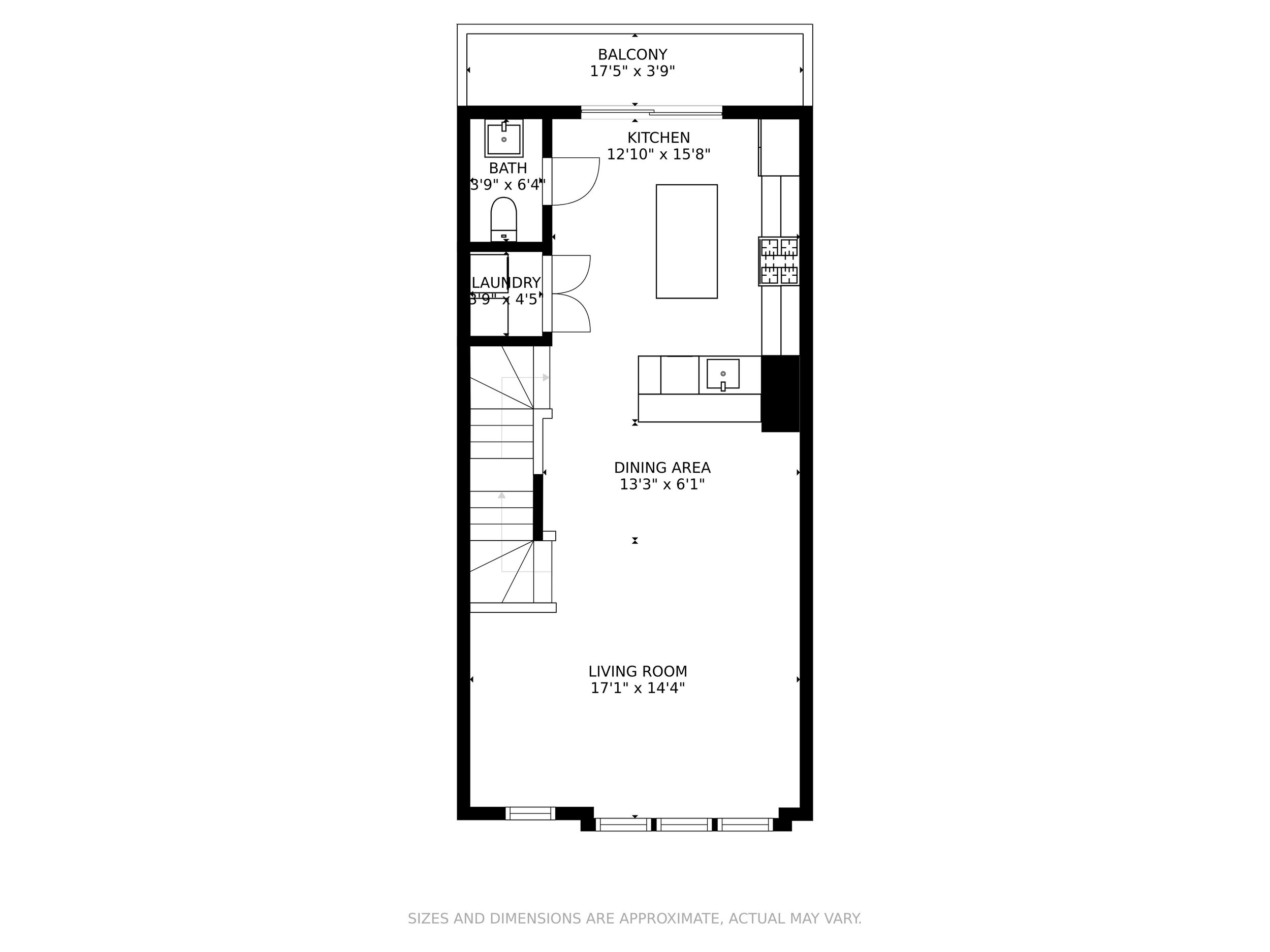

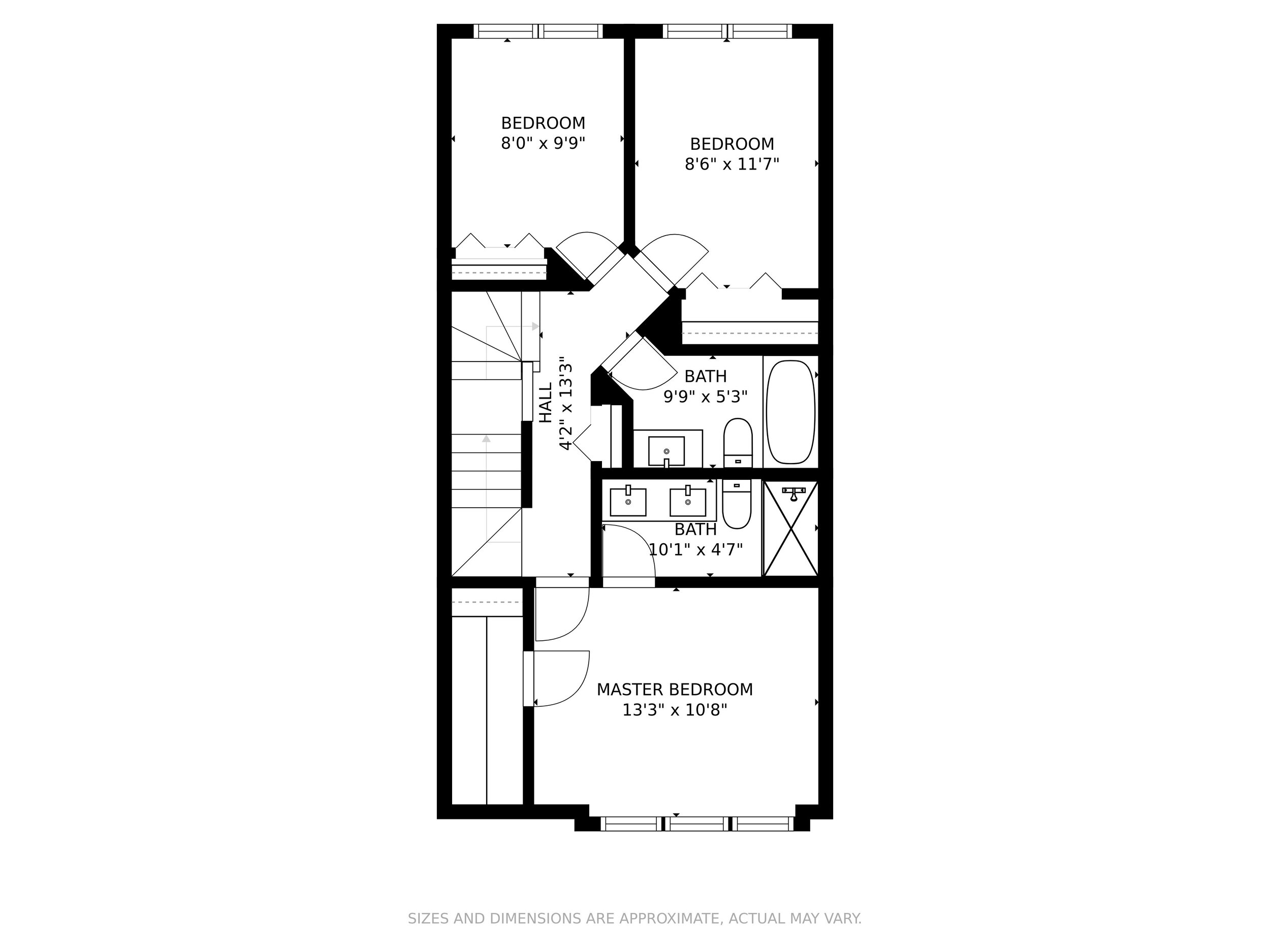

Bridgeport Property for Sale | 3615 S Morgan | 3 Bed | 2.2 Bath | $460,000

Listing Description

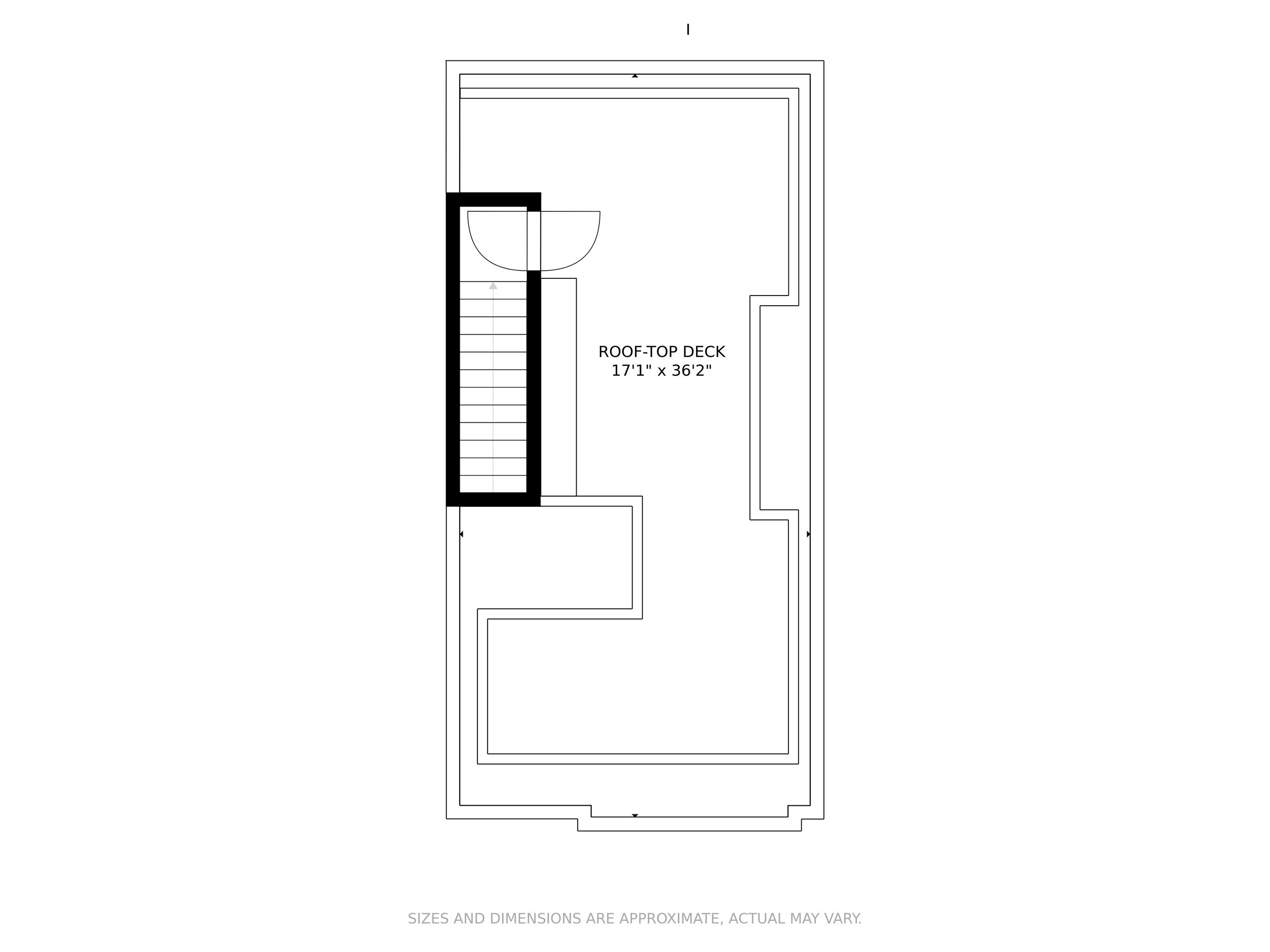

A beautiful townhome in a great location, this 3-bedroom, 2.2-bathroom, plus office home in Bridgeport is right where you want to be with easy access to local transit, dining, and amenities, including a one-minute walk to Donovan Park. Just built in 2017, this like-new home offers a modern open floorplan and updated fixtures to make this space both beautiful and practical. Sleek designer flooring and warm natural light highlight the beautiful entertainment space just waiting to host your next gathering. The thoughtfully designed kitchen is perfect for the home chef with luxe granite countertops, plenty of custom cabinetry, and updated stainless-steel appliances and hood. A bonus island provides even more prep space, as well as breakfast bar seating for two, while the large pantry gives extra storage and includes a washer and dryer.

Oversized sliding doors lead directly to your private outdoor balcony, complete with a natural gas line for grilling and space for al fresco dining. You can also enjoy great city views and ballpark fireworks directly from your own expanded full rooftop deck. Back inside, the bedrooms are bright and airy with bathrooms that have been beautifully finished, including a large master suite with walk-in closet and sparkling ensuite bathroom. The first floor is just right for a home office or workout room. A modern layout, upgraded finishes, and plenty of features that include an attached two-car garage make this a must-see home you don’t want to miss – call today for a private showing!

Schedule your private showing today!

Interested? Get More Info Below.

Location:

3615 S Morgan St

Chicago, IL 60609

Skokie Property for Sale |9345 Kolmar Avenue Skokie, IL 60076 | 4 Bed | 3 Bath | $349,000

Listing Description

Don't miss this bright and spacious single-family 3-bedroom, 3-bathroom home! Boasting a great location, you will love living across the street from a large park with baseball, basketball and tennis courts! Enjoy years of maintenance free living in this charming home that has been meticulously updated from the inside out with newly-installed hardwood floors throughout, a brand-new roof, water heater and furnace! The updates continue in the serene backyard with a new privacy fence and gazebo to give you the perfect outdoor oasis. With a great location and tons of updates, this one won't last long!

Schedule your private showing today!

Interested? Get More Info Below.

Location:

9345 Kolmar Avenue

Skokie, IL 60076

University Village Property for Sale | 1524 S Sangamon | 2 Bed | 1 Bath | $222,900

Listing Description

Sleek, modern and in the perfect location, you don’t want to let this chic condo pass you by. Located in highly-desirable University Village, you’ll love easy access to nearby dining, shops and nightlife, and just a quick commute downtown. An open concept entertainment space welcomes you into the home, highlighted by hardwood floors and tons of natural light. The modern kitchen is fully equipped and even offers bonus breakfast bar seating at the oversized island. Large sliding doors lead to your private patio with space for a grill and al fresco dining. This must-see condo won’t last long – call today for a private showing!

Schedule your private showing today!

Interested? Get More Info Below.

Location:

1524 S Sangamon

St, Chicago, IL 60608

Relocating To & From Chicago

Are you Relocating to a home in Chicago? Are you moving out of the Chicago area and need a Real Estate Agent you can trust? In todays video, I will cover an overview of what I can do to help you.

““Let me make sure you are well taken care of.””

Although I am a Chicago Real Estate Agent, I do have a wide variety of agents in my Network in many different areas that may be the best fit for you.

Top 10 Questions to Ask About Your Home Insurance Policy

Buying a new home requires a lot of preparation, including looking for a home insurance policy that provides the coverage you need. Although United States law does not require you to purchase homeowners insurance, it is necessary if you are dealing with lenders or mortgage providers.

If it is your first time to buy a policy, you must know what you need or what you are looking for. If you already have homeowners insurance, you must understand what your policy covers and how it protects your home and personal belongings. Talking to your insurance agent will provide the information that will help determine the right coverage for your home.

Here are ten home insurance questions to ask about and discuss with your agent.

1. What does my home insurance cover?

Home insurance policies vary in many ways, but they always provide these four customary coverage: dwelling, personal property, loss of use, and liability.

2. What is dwelling coverage?

Dwelling coverage protects your home’s structure, particularly if any part of it is destroyed by specific perils or events. Any structure attached to your home – such as your garage, roofing, walls, foundation, flooring, and even built-in appliances – is covered.

The perils or events covered by standard dwelling insurance are fire, smoke, theft, lightning, explosions, vandalism, sleet, hail, wind, and falling objects.

Dwelling insurance does not cover damage due to earthquakes and flooding.

3. What is personal property coverage?

Personal property coverage is intended for your personal belongings or the items found inside your home. The policy protects your electronics, furniture, jewelry, and clothing. To determine how much coverage you need, make a detailed inventory of all your personal belongings. Give a copy to your insurance agent.

Valuable items such as artworks and jewelry have sub-limits on their coverage. The policy only pays up to a particular amount. As such, if the total amount of your jewelry coverage is $2,000, that is what your insurance will pay you regardless of how much the actual cost of your items is.

Some homeowners prefer to include an add-on to their policy by scheduling or itemizing all their valuable items. Your insurance agent should know what else you need to do to increase coverage.

4. What is loss of use coverage?

Loss of use coverage protects you when your house is damaged and temporarily uninhabitable after being hit by fire or any covered perils. Also known as ALE or additional living expenses, this coverage is only for additional costs incurred while you are not residing in your home. Let’s say you’re living in a hotel or motel or an Airbnb unit; your policy will pay your temporary housing costs as well as public transportation spending. If you have a car and your budget for gas increased – from $100 a month to $200 a month – the policy will reimburse the additional $100 you spent.

Other expenses covered by loss of use protection are parking fees, additional food expenses, excess of normal or regular grocery expenses, and pet boarding. On top of these benefits, your policy also covers the cost of rebuilding your home, as well as the belongings that were affected by the peril.

Talk to your insurance agent to find out what your loss of use coverage includes, as most insurance companies have varied exclusions.

5. What is liability coverage?

Liability coverage is what protects you when one of your household members (including your dog) injures another person (such as a guest or neighbor). It is also the protection you need when someone from your family causes unintentional damage to another person’s property.

The coverage provided is dependent on the policy limit. Some homeowners discuss the possibility of getting an additional coverage limit with their insurance agents, which is particularly vital for those with pets.

6. What factors affect the cost of my home insurance?

The location of your home, its susceptibility to damage, and the amount it is insured for. If your home is in an area close to bodies of water, and if it is made of substandard materials, your home insurance cost is higher.

Other factors that affect homeowners insurance cost include claims history and how old your home is. What your house is made of also matters, especially if it is prone to rotting and termites.

7. Is there a way for me to reduce my home insurance cost?

One of the best ways to reduce home insurance costs is to compare quotes from different insurers. Take note of their coverage and decide which one is best for your needs.

Raising your deductible will significantly reduce your premium, so you should also consider this option. Likewise, you can ask your insurance agent about discounts as agencies regularly offer them.

8. What is ACV or actual cash value?

ACV or actual cash value is a policy that uses your property’s condition, life expectancy, and age in determining its worth and how much to pay you. It is less expensive but does not pay for the complete rebuilding and repair of your home or the damaged property.

Actual cash value protects your personal belongings, such as appliances, furniture, and clothing.

9. What is RCV or replacement cost value?

RCV or replacement cost value is a policy that pays the cost needed to rebuild or restore your damaged property. It replaces the damaged item with a new one and does not deduct for depreciation. It is more expensive than ACV but is worth the investment as it has wider coverage.

Replacement cost value is for protecting the structure of your home.

10. What is the usual rate of homeowners insurance?

Homeowners insurance costs differ according to your location or state. As of the year 2020, the average cost is estimated at more than $1,400 a year. The top five states with the most expensive home insurance cost are Oklahoma, Kansas, Texas, South Dakota, and South Carolina.

Talk to your insurance agent if you need more details on homeowners insurance.

How Much Profit Can You Keep When You Sell Your Home

Keep $250,000 profit if you sale your home tax free! Watch this to find out more.

“Taxes can have a profound impact on your financial future.”

-Realtor-Tom Campone

South Loop Property for Sale | 1819 S Michigan #603 | 2 Bed | 1 Bath | $300,000

Listing Description

Chic and stylish, this bright and open apartment sits in the heart of the South Loop on Michigan Ave. and is right where you want to be near all the best shops, dining and amenities. Inside, modern finishes pair with industrial touches in the gorgeous open entertainment space full of natural light. Designer flooring and high-end fixtures fill the space, including the large kitchen that offers tons of storage, stainless-steel appliances, and an oversized island with breakfast bar seating. A private terrace gives even more space to entertain. The bedrooms are bright and roomy and share a beautifully-finished full bathroom. Don’t let this one pass you by!

Schedule your private showing today!

Interested? Get More Info Below.

Location:

1819 S Michigan Ave

Chicago, IL 60616

2020 Market Update - Expert Panel Discussion

The information and the data is very unclear this year with the current living situations we are facing.

What do you think will be happening in the quarters to come in the REAL ESTATE MARKET?

Watch this video presented by Real Estate Investment Group -Gio featuring

Tom Campone, Keller Williams

National Lending Expert, Nelson Morales of BlueLeaf Lending (Lends in ALL 50 STATES)

as they discuss some of the points of the Market Update,

and share information about upcoming interest rate trends, hosing, commercial and industrial trends nationwide, in Chicago, and in Las Vegas.

“Demand dropped, but only 10-15% and supply got cut in half year after year. In the 4 weeks of March- April, it became a sellers market! Demand is high with low supply.”

-Realtor-Tom Campone

Top Things To Consider When Buying A Home

Before you start searching for a home, narrow down the neighborhood, budget (regardless of approval), and last the characteristics for your home!

Watch this video to find out tips that help you start your home search!

“Narrow it all down and get the best deal on the home you want.” -Realtor-Tom Campone

Why You Need A Strong Pre-Approval

Kyle Perks from GUARANTEED RATE and I go over the process of buying your first home! Kyle is an expert in the pre-approval process.

Watch this video to find out what tips he gives to have a strong pre-approval to begin your home buying road.

“Determine your goals, provide the income, credit, and asset documentation.” -Kyle

South Loop Property Now Available | 1516 S Wabash Ave #707 | 1 Bed | 1 Bath | $244,900

Listing Description

Parking included in this modern industrial apartment in the perfect location.

Facing north with gorgeous city views, this conveniently located one bedroom in the South Loop is right where you want to be.

The chic industrial finishes are highlighted by plenty of natural light and hardwood floors throughout.

A modern kitchen boasts stainless-steel appliances and spacious island for bonus breakfast bar seating and overlooks the roomy living area with gas fireplace.

Offering includes in-unit laundry, a deeded indoor parking space and private balcony, this home won’t last long.

This building is FHA approved.

Call today for your private showing!

Interested? Get More Info Below.

Location:

1516 S Wabash Ave #707

Chicago,IL 60605

What To Look For When Picking A Broker

In todays market you probably know a handful of real estate agents. But how do you choose the right one for you?

Below are some criteria that I believe make a difference when choosing a real estate broker.

INTEGRITY

Your broker should be working for you. This means that sometimes they should advise you to walk away from a purchase. When working with clients we always put together an analysis of the property we are writing an offer for.

During this process we know very closely how much the home is worth and our walk away number. We also analyze the market to see how much inventory is available and the competitive landscape. This additional data helps us put together a game plan on our offer that puts us in the best position to purchase the property below market value.

UNDERSTAND THE ENTIRE TRANSACTION

Some brokers only understand the purchase or sale portion of the transaction. Prior to becoming a real estate broker I spent time in the banking industry and the insurance industry so I understand the lending process and how to navigate the insurance markets. This has given me a more holistic understanding of the real estate process and has allowed me to advise my clients throughout the entire home buying / selling process.

TOP NEGOTIATOR

The minute you hear the words "split the difference" you are leaving money on the table. We pride ourselves on negotiating like it's our money so if we can get any additional dollars during the negotiation WE WILL!

When someone asks to split the difference there is most likely additional dollars to win in the negotiation. Don't get caught in this trap and hire a broker that will negotiate like it is their money.

If you are looking to make a move in the next year, I'd love to set up a time to talk. You can respond to this email or click the link below to set up a time to talk. Have a great day and I look forward to talking with you soon!

How Long Does It Take To Buy a Property?

The buying process varies greatly from client to client but I've developed a

Roadmap of a Transaction to give clients a better idea of the timeline for each step.

Step 1: Engage a Broker

Always the first step as far as getting started in your home buying process is finding a broker. As a personal tip from me, you want to pick someone that you trust and that is experienced with your wants and needs.

“It takes 45-75 or more days to buy a property”

-Real Estate Agent Tom Campone

Step 2: Pre-Approval (3-5 Days)

More specifically, the first step in the home buying process is working with a lender to get a pre-approval. To get pre-approved you will provide all your financial statements to a lender. Once reviewed they will give you a pre-approval letter with the amount of the loan you qualify for. The pre-approval process is important because we will need to include this letter with the offer.

Step 3: View Properties (1-21 Days)

This is the fun part of the process. We get to start shopping! Before we go shopping we will use an online search as a first showing. You will probably review 100-200 properties depending on how well you've defined your criteria. Out of that group of properties our goal is to narrow that down to 6-10 properties. Once we have the list narrowed down to 6-10 we will schedule a day to go out and see all of the units. If we see all the units back to back it will give you a great comparison of the inventory available throughout your budget. Inevitably there is 1 or 2 units that stand out from this group.

Step 3: Write an Offer (1 Day)

Once we've found the property for you it's time to write an offer. Before we write the offer I will put together a detailed analysis of the property and I will give you my opinion of the price. The analysis will also include the market information of how much inventory is on the market and absorption rate. This will give us a wholistic view of the market and we can start to strategize on how to get you the best price for the unit.

Step 4: Negotiate (1-2 Days)

This is where the rubber hits the road. If we've done our job analyzing the property we can feel confident in our offer and our negotiating position. I negotiate like it's my money so if I can get you another $500 or $1,000 in the transaction I will tell you and we will go after it for you.

Inspection (3-5 Days)

Once we have agreed on the terms of the transaction we will hire an inspector. The inspectors job is to find problems so don't be surprised when they do. Once the inspection is complete they will send you a detailed report with their findings. It's important that you attend the inspection as the inspection items can seem a little scary unless you are there to ask questions and talk with the inspector. I recently had an inspection where there were some electrical issues. If the client was not there to hear that it is an hour fix with an electrician it could have become a larger issue.

Step 5: Attorney Review (3-15 Days)

After the inspection has been completed we will regroup with your attorney to discuss closing cost credits or repairs for anything that was found during the inspection. For anything of substance (electrical items, etc) I suggest getting a credit and having the repairs completed yourself. For minor items, you can request that the owner complete the repairs.

Step 6: Underwriting of Loan (14-35 Days)

Once we pass attorney review you will post the remainder of earnest money and wrap up the last items for the lender. At this point you are committed to the purchase of this property.

Clear to Close

About a week prior to closing you will receive the clear to close from your lender. This means your loan has been officially approved. Remember not to open any new credit lines or make any large purchases until 3 days after closing as this could affect your debt to income ratio and could cause to you no longer be approved. Mortgage companies check all of these ratios the day before a closing to make sure everything is the same as underwriting.

How To Get The Most Money for Your Home

Wondering if you should conduct upgrades to your home prior to listing it? Debating on what upgrades should be made?

If you ask someone selling a car what they do before they sell it most will tell you they have it detailed. This is no different when trying to sell a house.

BUT where do you spend your money to maximize your investment?

Jack Kalinski from Kali Group shares a few minutes with me discussing how to prepare your home to sell for top dollar.

Preparing your property for sale will help you get the best price for your home. It will also help you decrease the time it takes to sell your home! Therefore, preparing your home prior to selling…

Saves you time

Money

And comes with less stress!