I hope you and your family had an amazing start to the year and are enjoying the summer weather. I’ve been getting a lot of questions lately about the Federal Reserve, interest rates and home values so I thought I’d compile my thoughts into this newsletter.

We’ve all been reading the news headlines, inflation is at a 40 year high, mortgage applications are dropping, buyers are cooling down, etc. But what is really going on and what do we expect going into the 2nd half of 2022 and into 2023?

Mortgage Rates Will Continue to Go Up (through 2022)

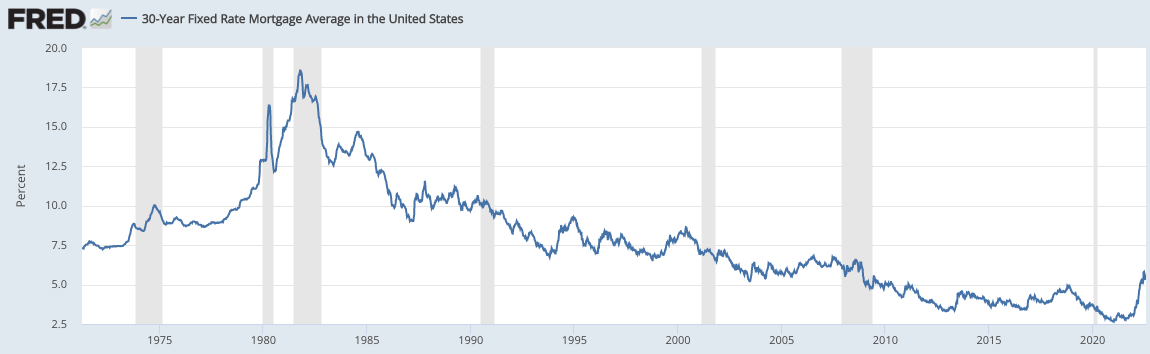

Expect mortgage rates to continue to go up through the end of 2022. They could even touch 7% which may sound crazy until you look at a historical chart. We are still in a favorable rate environment just not an extremely favorable rate environment.

Buyers are recalibrating their expectations

Right now buyers are recalibrating their expectations. Some believe that the market will correct and prices will go down and some are recalculating what they can afford and whether they want a turn key product or are willing to do some work. This is an interesting point in the market right now because there is no real direction and it’s not clear if we are going to enter a buyer’s market or if this is just going to be a bump in the current market.

Market Time Will Increase

I don’t believe we will see prices decrease in any significant way however, I do expect to see market time increase as the buyer pool decreases due to the increase in rates.

Price Growth Will Slow

I don’t anticipate that prices will decrease but the rate of growth will definitely slow with the increased rates. If we look at prior recessions, real estate prices have increased in 3 of the last 5 recessions. I don’t see a major correction in order for a few reasons. The largest of which is inventory. New housing starts have been below average since 2010 and have just recently increased to the historical norm. Last week the home builder sentiment index came in very low so expect new inventory to drop through the rest of 2022 and most likely the first half of 2023. The current level is not enough to satisfy the demand and if housing starts decrease it will have further negative impact on supply.

Inventory Will Tighten

I’ve thought about this a lot and I believe that the increase in rates is actually going to hurt the amount of inventory. A lot of homes were purchased since the financial crisis and values have gone up significantly. Many people have refinanced during the past 5 years and have locked in a very low interest rate. Sellers are looking at the prospect of paying a premium on their new home and locking in a significantly higher interest rate so they are opting to stay in their current residence. These rates are also having an impact on financing costs for builders which is part of the reason that the builder sentiment was much lower than earlier in the year.

Foreclosure Headlines Will Start to Emerge

Expect to see headlines about foreclosures in the upcoming months. This is typical during this part of the cycle. I anticipate that foreclosures will return to historical norms but with the current valuations and the amount of equity in most people’s homes, the foreclosure data will be very low and will be absorbed by the market without impacting valuations.

So where do we go from here? I see three likely scenarios for the next 12 months.

1. Rates Increase / Values Cool

This is the scenario that the Federal Reserve is trying to achieve. As with all policies there are unintended consequences. I’m surprised to see how much the activity cooled since June so the Fed may achieve their goal.

2. Rates Increase / Value Increase

Most news outlets are not talking about this possibility but if you look at the section above about inventory you see a scenario where increasing rates actually decrease the supply of homes in a significant way. The Fed is trying to decrease the demand by increasing rates but they may not have the stomach to increase rates enough to shrink demand. What we know from economics is if the supply is low and the demand is high, you can expect prices to increase.

3. Rates Increase / Volume Dips 2H 2022, Rates Recede in 2023

I believe it will be a long time before we see interest rates in the 3% range but I also believe that the Fed does not have the appetite to keep rates high for more than a year or two. I expect rates to peak in Q4 2022 and then start to recede by mid 2023. It will be a while before you see them in the 4’s again but expect a gradual decrease as we come out of this inflationary period.