Some people debate if owning your home is a “good” investment. I came across this great podcast from Creative Planning that covers home ownership from a financial perspective as well as a personal perspective. They talk about how part of your home is consumable which I agree with and how the rent vs buying equation plays out. It’s a quick listen and well worth your time. Hit the link below to set up a time if you want to talk about your next move.

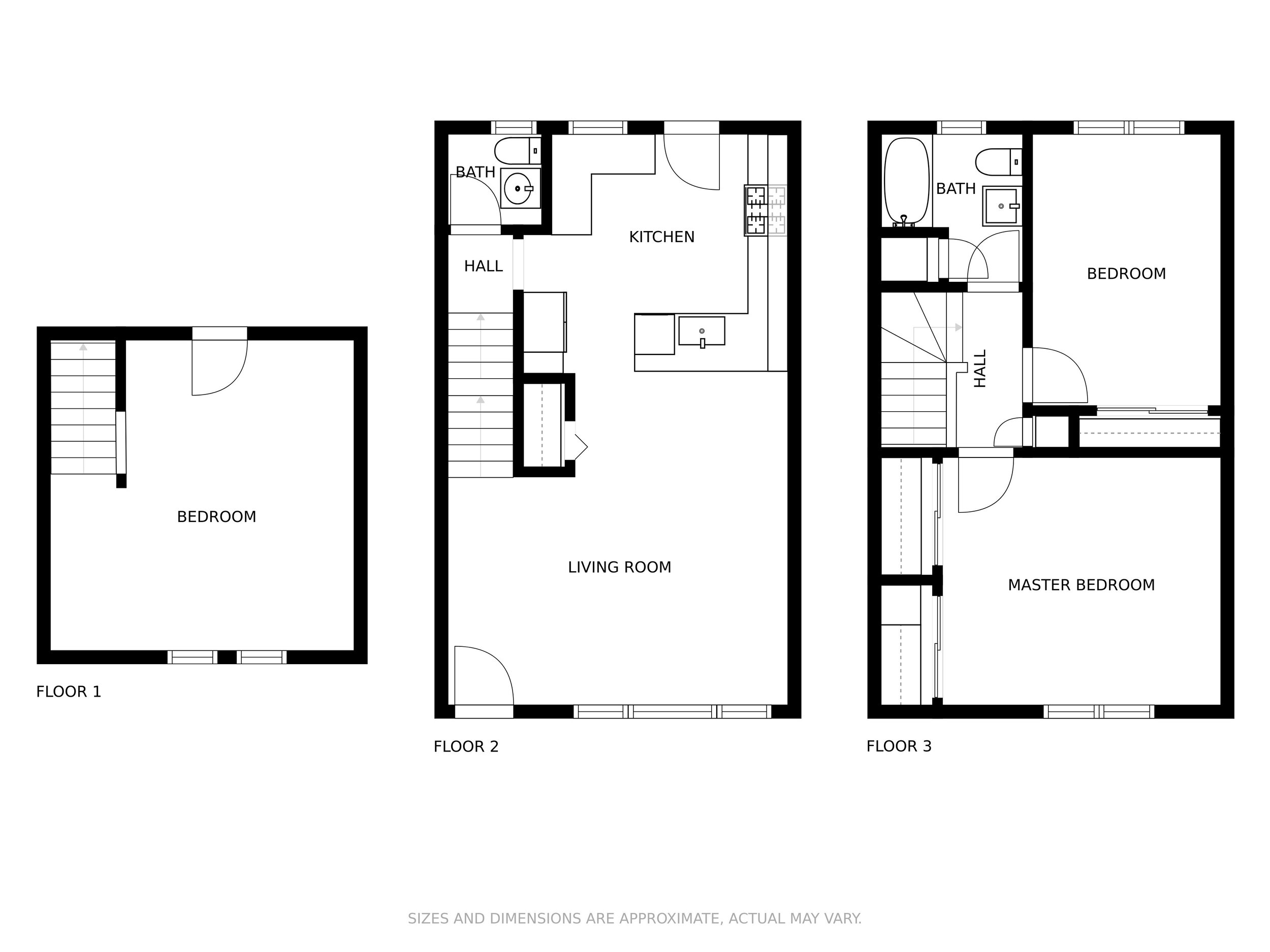

South Loop Property for Sale | 1813 S Clark St | 3 Bed 2 Bath

A gorgeous townhome in the absolute perfect location, you will love being walking distance to Soldier Field, the Museum Campus, local schools and all nearby transportation. On the first level of this 4-story home is your own private 1 car garage, followed by a few stairs that take you to your incredible entertainment space - totally open concept with designer flooring, upgraded fixtures and a beautiful kitchen. The next floor houses the bright and spacious bedrooms including a sprawling master suite with walk-in closet and large ensuite. Finally, the top floor is bonus entertainment space with a second family room and a large private balcony the whole family will love. This home is sure to go quickly - call today to schedule your private showing!

South Loop Property for Sale | 1717 S Prairie Ave #1401 | 3 Bed | 2 Bath

In the desirable neighborhood of South Loop, stunning and modern 3 bedroom unit in the historic Prairie District. As you step inside you will be drawn to the beautiful view of the skyline, lake, and Soldier field. A fully- equipped chef's kitchen with high end SS appliances, oak cabinetry, granite counter tops and breakfast bar. Large living room opens to balcony, enjoy entertaining with magnificent views of the city. Luxurious Master Bath En-Suite with Whirlpool Tub, Separate Shower, and dual vanity. The primary and Second Bedroom have generous closet space and newer Carpet. In unit washer and dryer, hardwood floors throughout and much more! Full amenity building with 24-hour doorman, on sight manager, large workout room, sauna, party room, extra storage, media room, pet friendly building. Nearby to everything in South loop including dog park, lake front, restaurants, Trader Joe's, Mariano's, CTA, & more!

Five Tips for Landing A VA Mortgage

One standout benefit of serving in the military, National Guard, or Reserves is your eligibility to apply for a VA mortgage. Administered through a wide range of lending institutions, VA loans are guaranteed by the federal government. That’s why they typically feature lower interest rates and more lenient qualification standards. Many service members purchase their homes through the VA with no money down. Overall, lenders consider VA loans less risky than conventional private mortgages.

To be eligible for a VA loan, you must be an active or former member of the military. Generally, you must have been honorably discharged, though there are rare exceptions to that rule. Surviving spouses of veterans can also apply for a VA loan unless they have remarried. Depending on when you served and why you were discharged, there are service benchmarks you must meet in terms of time served. But just because you qualify to apply for a VA mortgage, doesn’t necessarily mean you’ll be able to secure one. Here are a few tips for increasing your chances of being approved to take advantage of this valuable benefit.

Tip Number One: Don’t Let the Paperwork Overwhelm You

Applying for any mortgage can be confusing and time-consuming. But VA loans come with an additional layer of complexity. Anything involving the government comes with red tape, right? You’ll need to secure a Certificate of Eligibility to be approved for a VA loan, which involves gathering a little more documentation than you would need to apply for a conventional loan. But you don’t need to have a certificate to begin the VA loan application process. In fact, most lenders will be glad to assist you in getting one. Remember that lenders want your business. And a good one will bend over backwards to get it.

Tip Number Two: Your New Home Needs to Be Eligible, Too

Here’s why working with a VA loan-savvy realtor can be a tremendous boon: the last thing you want to do is spend time trying to purchase a property that won’t qualify for a mortgage in the end. The government doesn’t want to invest in properties that have major defects and neither do you. They’ve established a set of Minimum Property Requirements for homes purchased under the VA loan program. Your realtor or lender can explain these to you and help you steer clear of properties that don’t stack up to VA standards.

Tip Number Three: Get Familiar with Acceptable Use and Occupancy Guidelines

VA loans aren’t made for every type of property. Loans are only written for primary residences. Your new home can be a Colonial, a condo, a manufactured home, or anywhere in between but you have to live there. You can even take out a loan to build a home from scratch. But vacation homes and investment properties aren’t eligible for VA financing. In addition, the VA sets time limits around occupancy. Generally, you must move into your home within 60 days of closing. If you’re currently deployed, that rule can be challenging. A spouse can substitute for a deployed service member to meet the occupancy date, but single people may have a harder time fulfilling the requirement. It can be done, though. A lender who has VA mortgage experience can help you iron out any occupancy issues you may have.

Tip Number Four: Your Credit Counts

One important advantage VA loans have over traditional mortgages is that VA borrowers are subject to more lenient financial qualifications. Officially, there is no credit score bar you have to clear before you can be approved for a VA mortgage. But having good-to-excellent credit can help you secure a larger loan and/or a better interest rate.

Even a quarter-point difference in the interest rate you’re offered can amount to thousands of dollars over the life of your mortgage. That’s why getting your credit in the best possible shape before you apply for a loan is essential. Download a free copy of your credit report from each of the three credit reporting bureaus to see where you stand. Then do whatever credit repair that needs to be done. Make sure all of your credit accounts are current—and stay that way—while you’re applying for a mortgage. Close any accounts that you’re no longer using. If you find any negative remarks on your report that aren’t legitimate, dispute them. Fixing mistakes on your credit report can take some time. So be sure you attend to your credit well in advance of submitting a loan application.

Tip Number Five: Get Pre-Qualified Before You Start House Hunting

Today’s real estate market is very competitive. Nowadays, home sellers are inundated with offers and 43% accept one within a week of listing their homes. Sellers aren’t interested in wasting time and want to talk to serious buyers only. Prequalifying for a loan through one or more lenders—that is, securing a letter that states how much money a lender would be likely to loan you and at what interest rate—is one way to show home sellers that it’s worth their time to work with you. Many home sellers won’t even entertain offers from buyers who aren’t prequalified.

Getting prequalified also can help you set home price parameters for yourself and hone in on properties you can reasonably afford. It’s easy to do. And it won’t affect your credit score, even if you prequalify with more than one lender.

South Loop Property for Sale | 1717 S Prairie Ave #1105 | 3 Bed | 2Bath

A gorgeous and modern apartment right in the heart of the Prairie District, you will love this 11th-floor unit in a full-service amenity building. A 24-hour doorman, fitness room, sauna and so much more make this South Loop home the exact place you want to be. As you step inside, rich hardwood floors, tons of natural lighting and a modern open concept entertainment space welcome you home. A fully-equipped chef's kitchen with high end Bosch SS appliances, solid cherry cabinetry, designer granite counter tops and Grohe faucets just perfect for the cook of the family. Enjoy entertaining in the roomy balcony with gorgeous city views. Beautifully finished and in the perfect location, you don't want to let this one pass you by!

South Loop Property for Sale | 1819 S Michigan Ave #507 | 2 Bed | 1 Bath

Don't miss this gorgeous two-bed condo in the absolute perfect location. Right on Michigan Ave., you will love being walking distance to public transit, all the best local shops and restaurants and just minutes to the Loop and Lakefront! From the moment you step inside, you're immediately greeted by the modern open concept entertainment area. Natural light pours inside from the floor-to-ceiling windows highlighting the rich hardwood floors. New washer and dryer installed and new shower doors. The full-size kitchen is fitted with stainless-steel appliances and looks over the spacious living and dining area. Outside, the entertainment space continues on the large balcony where you can relax and enjoy beautiful city views. Don't let this one pass you by!

River North Property for Sale | 333 W Hubbard #607 | 2 Bed | 2 Bath

A modern industrial loft in a great area, you will feel right at home from the moment you step

inside. Hardwood floors, a gas fireplace and exposed brick details bring plenty of character into

the space. The open concept entertainment area is perfect for lounging or hosting with the full

size kitchen completely open to the dining and living spaces. A private balcony is the perfect

place to unwind after a long day while soaking in the incredible city views. The bedrooms are

bright and spacious with soaring ceilings and ample closet space – each with access to its own bathroom.

Don’t miss this must-see- home- Call today for more info!

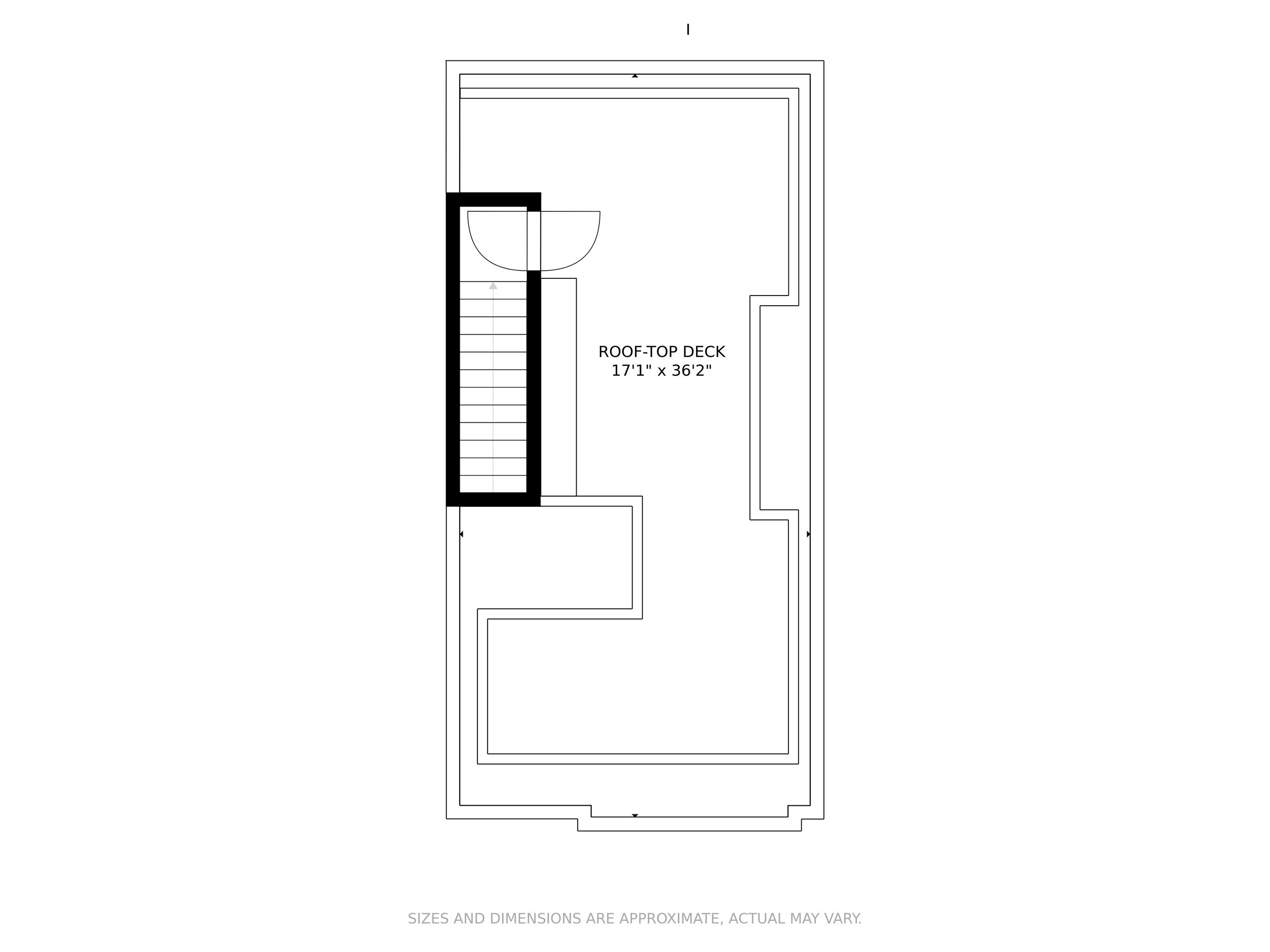

South Loop Property For Sale $500,000 | 1845 S State St Unit 4 | 3 Bed | 2 Bath

A must-see penthouse in a great location, you don't want to let this one pass you by. Sitting on the top floor of a great building in South Loop, this spacious and modern home is tastefully finished and right where you want to be. High end finishes fill the open concept entertainment space including designer flooring, crown molding and a gas fireplace. A gourmet kitchen is built for the chef of the family with custom cabinetry, Bosch appliances, luxe quartz countertops and a farmhouse sink. Enjoy extra entertainment space outside on the private rooftop deck where you can soak in beautiful city view from East and West. Nearby Green and Red CTA Transit stations, minutes away from Lake Shore Drive and expressways. Stylish, comfortable and centrally-located, don't miss this must-see home.

Lincoln Park Property For Sale | 1827 N Dayton St | 3 Bed | 2.1 Bath

Remarks: A must-see home in picturesque Lincoln Park, you don't want to let this one pass you by. Tastefully remodeled and full of charm, this 3-bedroom, 2.5-bathroom home offers an open concept entertainment space with fireplace, beautiful hardwood floors, all new trim throughout and plenty of natural light. The kitchen has been remolded with sleek quartz countertops, high-end stainless-steel appliances and plenty of custom cabinetry. New doors and windows throughout the unit. The bedrooms are bright and roomy, including the spacious master with private and fully updated ensuite. Plus, this home boasts outdoor space and an in-unit washer and dryer. You don't want to miss out on this gorgeous home - call today to set up your private showing!

Old Town Property For Sale | 1660 N Lasalle Dr Unit 2606 | 1 Bed | 1 Bath

Don't miss this chic and contemporary 1-bed, 1-bath in an unbeatable location. High-rise living at its finest, this home offers incredible amenities including 24/7 doorman, pool, gym, dry cleaners, indoor parking and more in the sought after Lincoln Park neighborhood with easy access to Lake Michigan and Lake Shore Drive. The entertainment space is bright and modern with gray wooden floors highlighted by designer light fixtures and floor-to-ceiling windows. The full-size kitchen boasts stainless-steel appliances, luxe quartz countertops and plenty of custom cabinetry. The entertainment space continues on your private balcony with breathtaking unobstructed views of the city. You don't want to miss this one - call today for more info!

Chicago Real Estate Market Update - March 2021

Oak Park Property for Sale | 644 Washington Blvd Unit A | 2 Bed | 1.1 Bath | $300,000

Listing Description

Don't miss this stunning updated townhouse in the village of Oak Park just a quick commute to the city. Renovated in 2017, this like-new home is full of character and completely move-in ready. Modern yet timeless, the high-end fixtures and designer flooring pair effortlessly to create the perfect space. An open entertainment area, oversized gourmet kitchen and bonus breakfast bar seating make this home as practical as it is cool. You'll love the private patio with space to entertain or relax with a cup of coffee. Beautifully designed and centrally located, this one won't last long. Schedule your private showing today!

Interested? Get More Info Below.

Location:

644 Washington Boulevard

Oak Park, IL 60302

South Loop Property for Sale | 1111 S Wabash Unit 911 | $375,000

Don't miss this bright and spacious 2-bedroom in the South Loop. Sitting in a high rise building with 24/7 staff, you will love the endless amenities including a gym, on-site cleaners, outdoor pool and more. The unbeatable location is right near Michigan Ave., Grant Park and all the best local shops and dining. Beautifully finished and full of natural light, this spacious apartment offers a sleek kitchen with luxe granite countertops and stainless-steel appliances, an open concept living and dining room combination and a sprawling balcony with stunning city skyline views. This is a must-see home - call today for more info!

Albany Park Property for Sale | 4944 N Drake Ave | Renovated 2 Flat | $675,000

About the Property

A stunning investment or income property opportunity, this two-flat duplex sits on a quiet, tree-lined street in Albany Park and is right where you want to be. The main level offers two bedrooms, one bath plus an additional 3 bedrooms and bath in the lower level, and the upstairs unit has three bedrooms and one bath, all tastefully updated and beautifully finished. Soaring ceilings in each highlight oak hardwood flooring and open concept floorplans fitted with recessed lighting. Everything has been recently updated, including the bathrooms and kitchens that boast beautiful stainless-steel appliances and quartz countertops. Renovated backyard/patio with custom built in grill, perfect for entertaining. A spectacular opportunity you don't want to miss!

Schedule your private showing today!

Interested? Get More Info Below.

Location:

4944 N Drake Ave

Chicago, IL 60625

2021 Chicago Real Estate Market Predictions

In this video I join a panelist of Chicago Real Estate Brokers and we give our predictions for the 2021 Chicago real estate market and discuss the current market conditions.

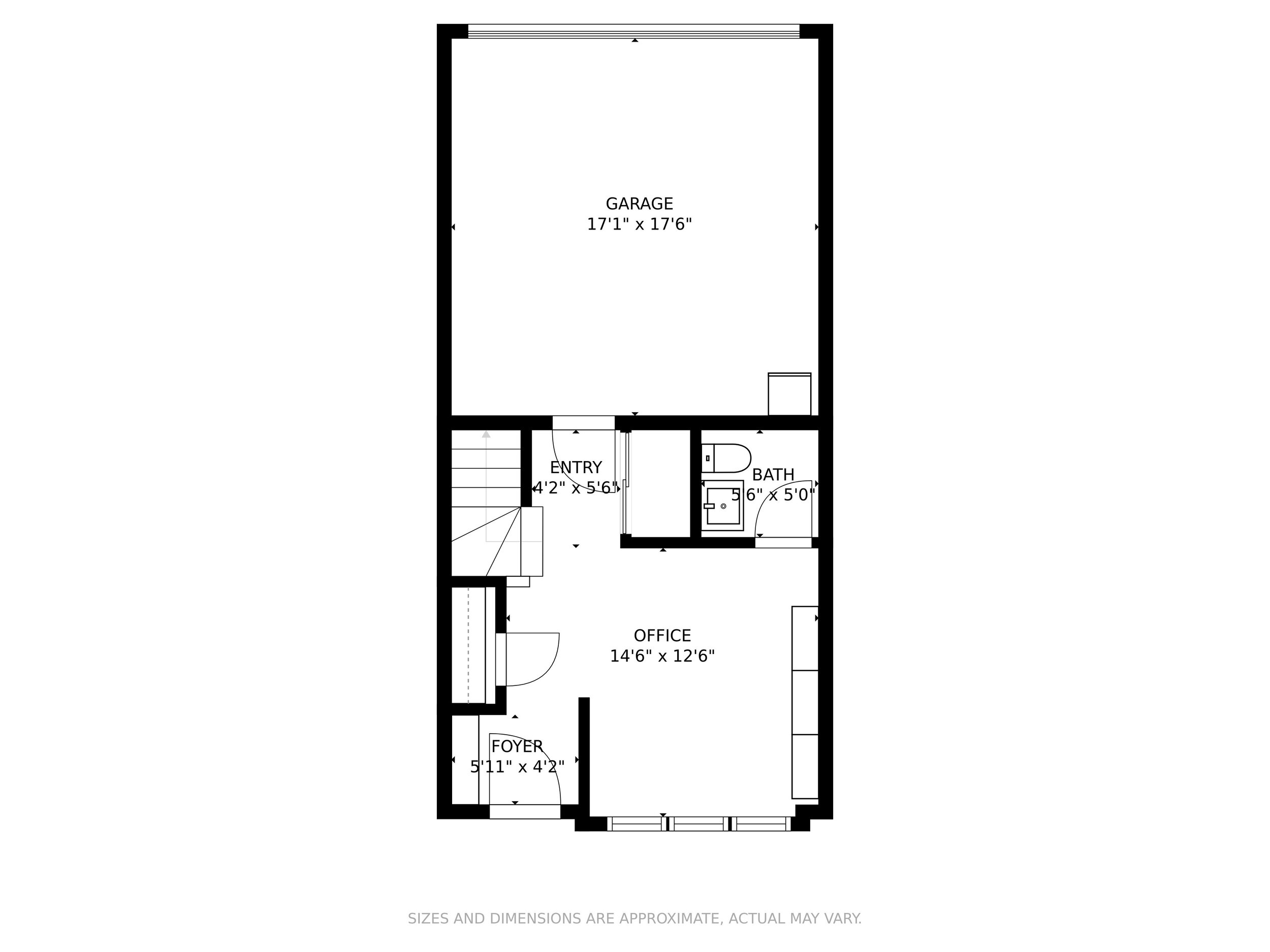

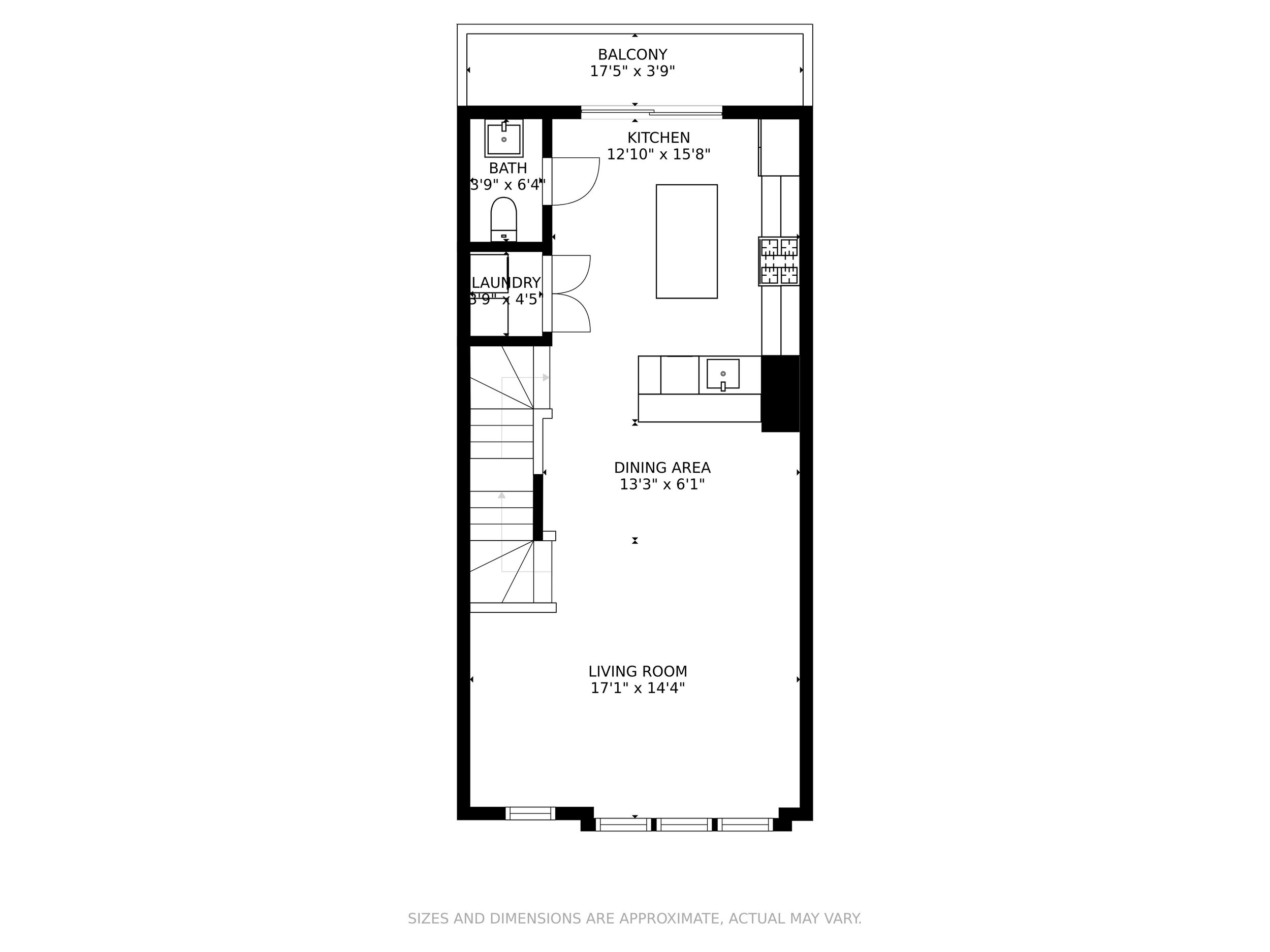

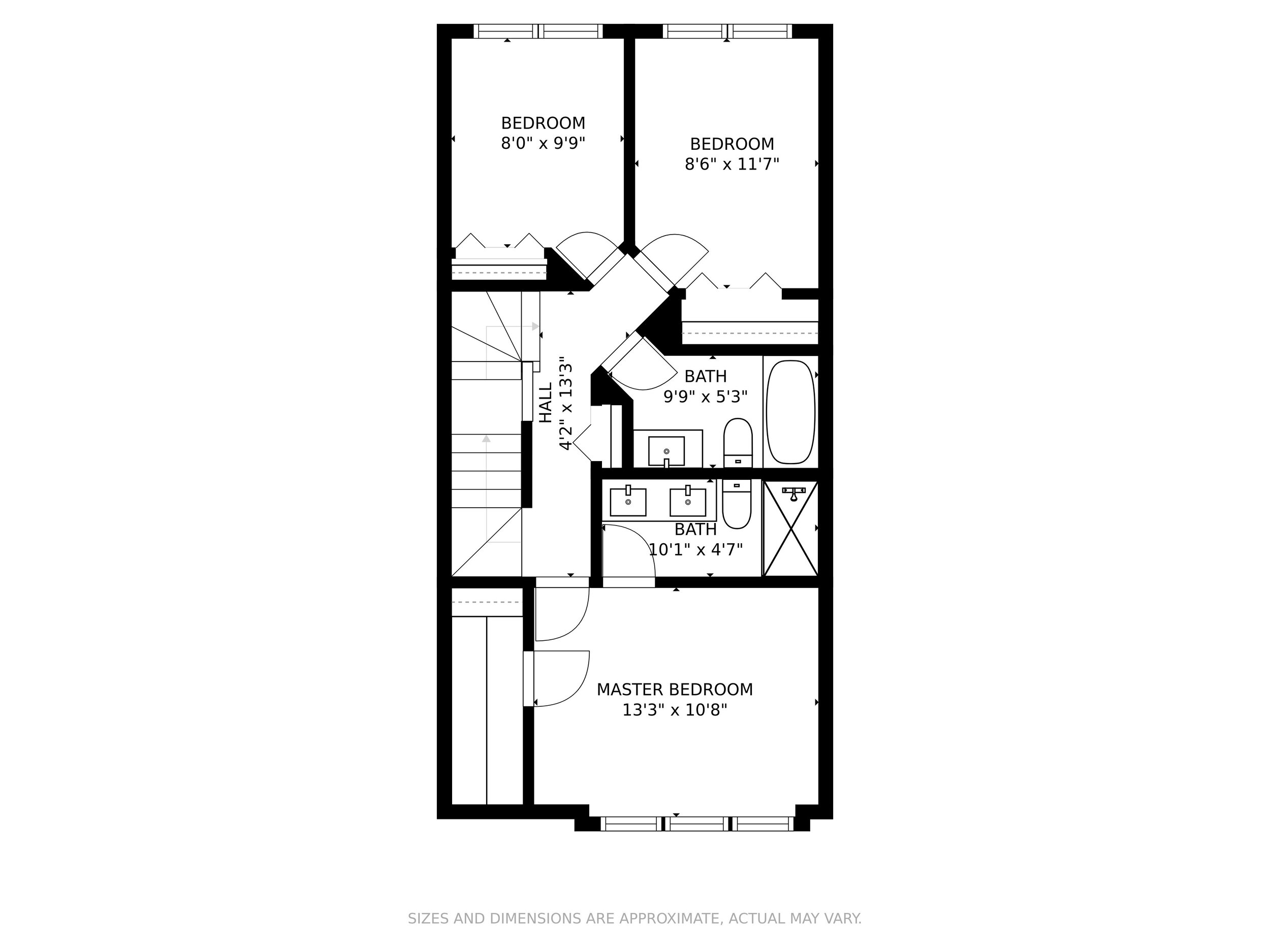

Bridgeport Property for Sale | 3615 S Morgan | 3 Bed | 2.2 Bath | $460,000

Listing Description

A beautiful townhome in a great location, this 3-bedroom, 2.2-bathroom, plus office home in Bridgeport is right where you want to be with easy access to local transit, dining, and amenities, including a one-minute walk to Donovan Park. Just built in 2017, this like-new home offers a modern open floorplan and updated fixtures to make this space both beautiful and practical. Sleek designer flooring and warm natural light highlight the beautiful entertainment space just waiting to host your next gathering. The thoughtfully designed kitchen is perfect for the home chef with luxe granite countertops, plenty of custom cabinetry, and updated stainless-steel appliances and hood. A bonus island provides even more prep space, as well as breakfast bar seating for two, while the large pantry gives extra storage and includes a washer and dryer.

Oversized sliding doors lead directly to your private outdoor balcony, complete with a natural gas line for grilling and space for al fresco dining. You can also enjoy great city views and ballpark fireworks directly from your own expanded full rooftop deck. Back inside, the bedrooms are bright and airy with bathrooms that have been beautifully finished, including a large master suite with walk-in closet and sparkling ensuite bathroom. The first floor is just right for a home office or workout room. A modern layout, upgraded finishes, and plenty of features that include an attached two-car garage make this a must-see home you don’t want to miss – call today for a private showing!

Schedule your private showing today!

Interested? Get More Info Below.

Location:

3615 S Morgan St

Chicago, IL 60609

Skokie Property for Sale |9345 Kolmar Avenue Skokie, IL 60076 | 4 Bed | 3 Bath | $349,000

Listing Description

Don't miss this bright and spacious single-family 3-bedroom, 3-bathroom home! Boasting a great location, you will love living across the street from a large park with baseball, basketball and tennis courts! Enjoy years of maintenance free living in this charming home that has been meticulously updated from the inside out with newly-installed hardwood floors throughout, a brand-new roof, water heater and furnace! The updates continue in the serene backyard with a new privacy fence and gazebo to give you the perfect outdoor oasis. With a great location and tons of updates, this one won't last long!

Schedule your private showing today!

Interested? Get More Info Below.

Location:

9345 Kolmar Avenue

Skokie, IL 60076

University Village Property for Sale | 1524 S Sangamon | 2 Bed | 1 Bath | $222,900

Listing Description

Sleek, modern and in the perfect location, you don’t want to let this chic condo pass you by. Located in highly-desirable University Village, you’ll love easy access to nearby dining, shops and nightlife, and just a quick commute downtown. An open concept entertainment space welcomes you into the home, highlighted by hardwood floors and tons of natural light. The modern kitchen is fully equipped and even offers bonus breakfast bar seating at the oversized island. Large sliding doors lead to your private patio with space for a grill and al fresco dining. This must-see condo won’t last long – call today for a private showing!

Schedule your private showing today!

Interested? Get More Info Below.

Location:

1524 S Sangamon

St, Chicago, IL 60608

Relocating To & From Chicago

Are you Relocating to a home in Chicago? Are you moving out of the Chicago area and need a Real Estate Agent you can trust? In todays video, I will cover an overview of what I can do to help you.

““Let me make sure you are well taken care of.””

Although I am a Chicago Real Estate Agent, I do have a wide variety of agents in my Network in many different areas that may be the best fit for you.

Top 10 Questions to Ask About Your Home Insurance Policy

Buying a new home requires a lot of preparation, including looking for a home insurance policy that provides the coverage you need. Although United States law does not require you to purchase homeowners insurance, it is necessary if you are dealing with lenders or mortgage providers.

If it is your first time to buy a policy, you must know what you need or what you are looking for. If you already have homeowners insurance, you must understand what your policy covers and how it protects your home and personal belongings. Talking to your insurance agent will provide the information that will help determine the right coverage for your home.

Here are ten home insurance questions to ask about and discuss with your agent.

1. What does my home insurance cover?

Home insurance policies vary in many ways, but they always provide these four customary coverage: dwelling, personal property, loss of use, and liability.

2. What is dwelling coverage?

Dwelling coverage protects your home’s structure, particularly if any part of it is destroyed by specific perils or events. Any structure attached to your home – such as your garage, roofing, walls, foundation, flooring, and even built-in appliances – is covered.

The perils or events covered by standard dwelling insurance are fire, smoke, theft, lightning, explosions, vandalism, sleet, hail, wind, and falling objects.

Dwelling insurance does not cover damage due to earthquakes and flooding.

3. What is personal property coverage?

Personal property coverage is intended for your personal belongings or the items found inside your home. The policy protects your electronics, furniture, jewelry, and clothing. To determine how much coverage you need, make a detailed inventory of all your personal belongings. Give a copy to your insurance agent.

Valuable items such as artworks and jewelry have sub-limits on their coverage. The policy only pays up to a particular amount. As such, if the total amount of your jewelry coverage is $2,000, that is what your insurance will pay you regardless of how much the actual cost of your items is.

Some homeowners prefer to include an add-on to their policy by scheduling or itemizing all their valuable items. Your insurance agent should know what else you need to do to increase coverage.

4. What is loss of use coverage?

Loss of use coverage protects you when your house is damaged and temporarily uninhabitable after being hit by fire or any covered perils. Also known as ALE or additional living expenses, this coverage is only for additional costs incurred while you are not residing in your home. Let’s say you’re living in a hotel or motel or an Airbnb unit; your policy will pay your temporary housing costs as well as public transportation spending. If you have a car and your budget for gas increased – from $100 a month to $200 a month – the policy will reimburse the additional $100 you spent.

Other expenses covered by loss of use protection are parking fees, additional food expenses, excess of normal or regular grocery expenses, and pet boarding. On top of these benefits, your policy also covers the cost of rebuilding your home, as well as the belongings that were affected by the peril.

Talk to your insurance agent to find out what your loss of use coverage includes, as most insurance companies have varied exclusions.

5. What is liability coverage?

Liability coverage is what protects you when one of your household members (including your dog) injures another person (such as a guest or neighbor). It is also the protection you need when someone from your family causes unintentional damage to another person’s property.

The coverage provided is dependent on the policy limit. Some homeowners discuss the possibility of getting an additional coverage limit with their insurance agents, which is particularly vital for those with pets.

6. What factors affect the cost of my home insurance?

The location of your home, its susceptibility to damage, and the amount it is insured for. If your home is in an area close to bodies of water, and if it is made of substandard materials, your home insurance cost is higher.

Other factors that affect homeowners insurance cost include claims history and how old your home is. What your house is made of also matters, especially if it is prone to rotting and termites.

7. Is there a way for me to reduce my home insurance cost?

One of the best ways to reduce home insurance costs is to compare quotes from different insurers. Take note of their coverage and decide which one is best for your needs.

Raising your deductible will significantly reduce your premium, so you should also consider this option. Likewise, you can ask your insurance agent about discounts as agencies regularly offer them.

8. What is ACV or actual cash value?

ACV or actual cash value is a policy that uses your property’s condition, life expectancy, and age in determining its worth and how much to pay you. It is less expensive but does not pay for the complete rebuilding and repair of your home or the damaged property.

Actual cash value protects your personal belongings, such as appliances, furniture, and clothing.

9. What is RCV or replacement cost value?

RCV or replacement cost value is a policy that pays the cost needed to rebuild or restore your damaged property. It replaces the damaged item with a new one and does not deduct for depreciation. It is more expensive than ACV but is worth the investment as it has wider coverage.

Replacement cost value is for protecting the structure of your home.

10. What is the usual rate of homeowners insurance?

Homeowners insurance costs differ according to your location or state. As of the year 2020, the average cost is estimated at more than $1,400 a year. The top five states with the most expensive home insurance cost are Oklahoma, Kansas, Texas, South Dakota, and South Carolina.

Talk to your insurance agent if you need more details on homeowners insurance.